- Organic eCom

- Posts

- The State of Play for Brands (July 2025 Edition)

The State of Play for Brands (July 2025 Edition)

Plus: Ruggable’s Winning Formula and our thoughts on AI Search and futureproofing your content.

Welcome to our monthly newsletter, which focuses on helping you reduce your reliance on paid media.

Here’s what we’re diving into:

AI Search: Future proofing your content - from our Substack

What’s Trending

Ecommerce Performance

Ruggable Case Study

Conversion Trends for July

Reserve your spot: Webinar on AI Search

From Substack: 🧠 AI Search: Future-Proofing Your Content

Search is getting smarter, and we’re not just talking keywords anymore. Think: someone snapping a pic of their bookcase and asking, “What should I read next?”

To help brands stay visible, we’ve launched a new content framework called SEED- built for the AI era of search.

From richer product pages to standing out with your brand’s values, this 4-part series breaks down how to adapt your content strategy for what’s next.

What’s Trending?

Our Content & Digital PR strategies focus on positioning clients' brands ahead of the latest trends. We develop strategic campaigns and newsjacking opportunities through comprehensive trend analysis and research.

Here are our current trend insights across key categories:

Food & Drink Gets Functional & Fusion-Focused

Malatang (+59% YoY): The spicy, build-your-own Chinese soup continues its rise as a social, street-food style comfort meal.

Prebiotic Soda (+33% YoY): Gut health goes fizzy — functional beverages are stepping into the mainstream.

Krapow (+26% YoY): A simplified take on Thailand’s spicy basil stir-fry gains traction among home cooks.

Pork Birria (+25% YoY): Taco culture evolves again — pork-based versions of the rich, slow-cooked stew are surging in search.

Lasagna Soup Recipe (+21% YoY): All the comfort of lasagna in a bowl — this one-pot trend keeps gaining cosy-season fans.

Beauty Gets Clinical & Customised

Lymphatic Facial (+73% YoY): This detox-inspired treatment is trending for its promise to de-puff, sculpt, and reset the skin barrier.

Exfoliating Acid (+36% YoY): From mandelic to glycolic, chemical exfoliants are in demand for smooth, glowing skin.

Rice Face Wash (+33% YoY): Gentle and tradition-backed, rice-based cleansers are rising in minimalist skincare routines.

Red Light Therapy Wand (+18% YoY): At-home LED tools are heating up, with a focus on anti-aging and inflammation.

Russian Manicure (+11% YoY): The ultra-clean cuticle look continues to dominate beauty salons and social media.

Fashion Gets Soft & Statement-Making

Super Baggy Jeans (+144% YoY): Denim continues its oversized era — baggy fits are winning across gender and style.

Flared Jeans for Men (+125% YoY): The ‘70s silhouette makes a menswear comeback.

Flat Back Earrings (+62% YoY): Designed for comfort while sleeping or wearing headphones — form meets function in everyday jewellery.

Necklace Stack (+57% YoY): Layered jewellery isn’t going anywhere — the trend thrives on personalisation and TikTok styling tips.

Bamboo Pyjamas (+31% YoY): Breathable, luxe-feel loungewear continues to dominate in the bedtime beauty space.

Health & Wellness Gets Cold, Bright & Connected

Japanese Head Spa (+86% YoY): A viral scalp care experience that blends relaxation with results — and it’s going global.

Chat Therapy (+71% YoY): Mental health support gets more accessible with text-first platforms surging in popularity.

Red Light Therapy (+60% YoY): Infrared skin tools aren’t just a beauty trend — they’re now part of full-body recovery routines.

Ice Sauna (+38% YoY): Hot-cold contrast therapy moves from elite athletes to wellness influencers.

Somatic Healing (+18% YoY): Trauma-informed, body-based healing continues to gain visibility in wellness spaces.

Home Gets Decorative & Detail-Oriented

Showpiece for Living Room (+28% YoY): Statement items are back — searches rise for centrepieces that tie a room together.

Bed Room Design (+14% YoY): Functional and aesthetic bedroom planning remains top of mind, especially in rental-friendly formats.

Pearl Decor (+12% YoY): Classic, delicate touches are showing up in everything from vases to candle holders.

Navy Blue Purple (+9% YoY): This moody, transitional hue is trending for interiors with depth and drama.

Decoration Piece (+5% YoY): Vague, but growing — a signal that consumers are in the mood to style, even without knowing what with.

Lifestyle & Culture Gets Reflective & Risky

Nicotine Pouch (+66% YoY): A rising alternative to smoking or vaping, especially in male wellness subcultures.

Femcel (+28% YoY): A previously fringe identity getting more mainstream attention and debate.

UGC Creator (+7% YoY): User-generated content continues to drive brand growth — more people are seeing this as a job, not just a hobby.

Ayahuasca Retreat (+11% YoY): Psychedelic tourism remains steady, with people searching for meaning and healing abroad.

AI Post Generator (+16% YoY): Content creation automation is being explored across influencer and small business circles.

Entertainment Gets Elevated & Immersive

Rank Anime (+82% YoY): Fandom culture continues to drive traffic — ranking content fuels debate and engagement.

UHD Movie (+36% YoY): As home cinema setups improve, ultra-high-def content is on the rise.

Manhwa (+21% YoY): Korean comics are breaking language and format barriers, becoming a global entertainment staple.

Candlelight Concert (+17% YoY): Intimate, atmospheric live music is in — and designed for Instagram.

Phonk Music (+4% YoY): The lo-fi, Memphis-inspired genre continues bubbling up in Gen Z playlists.

Technology Gets Practical & Physical

Teleoperation (+64% YoY): Remote control of robotics and vehicles is moving from R&D into commercial viability.

Aquablation (+52% YoY): Surgical tech meets water-based precision — niche but fast-growing in the medtech space.

Bidirectional Charger (+31% YoY): EV drivers are searching for tech that can give back — charging and supplying energy at once.

ESPHome (+18% YoY): DIY smart home setups continue to grow as consumers build custom automations.

VRModels (+18% YoY): Open-source 3D models for virtual reality are gaining traction among hobbyists and developers.

Email me at [email protected] for additional insights specific to your sector, including comparative analysis of trending terms across yearly, quarterly, or monthly periods.

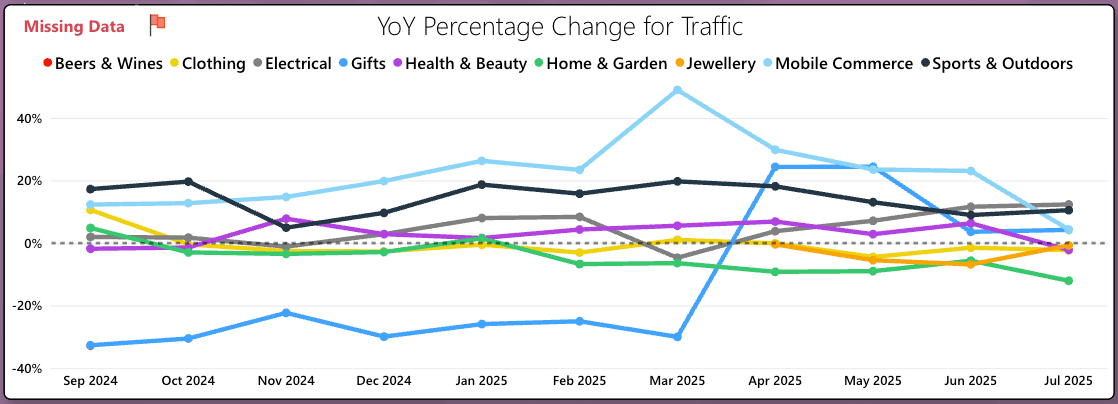

eCom Performance Trends in July

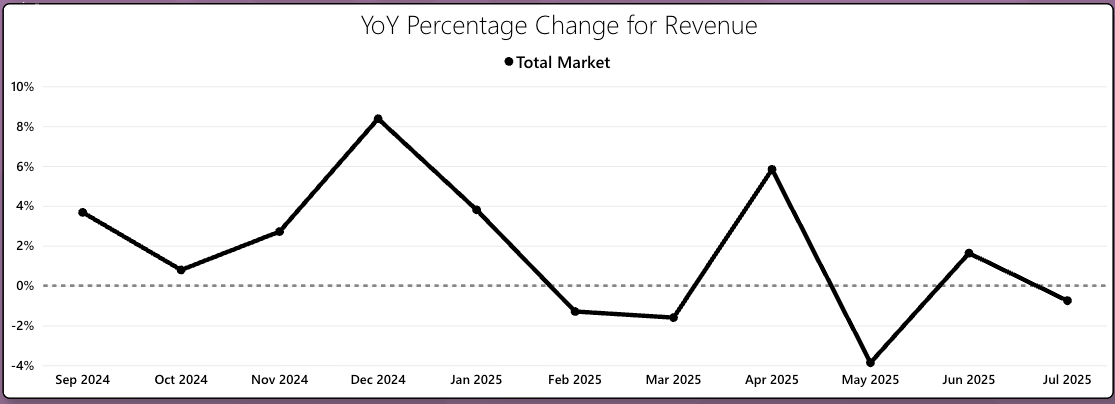

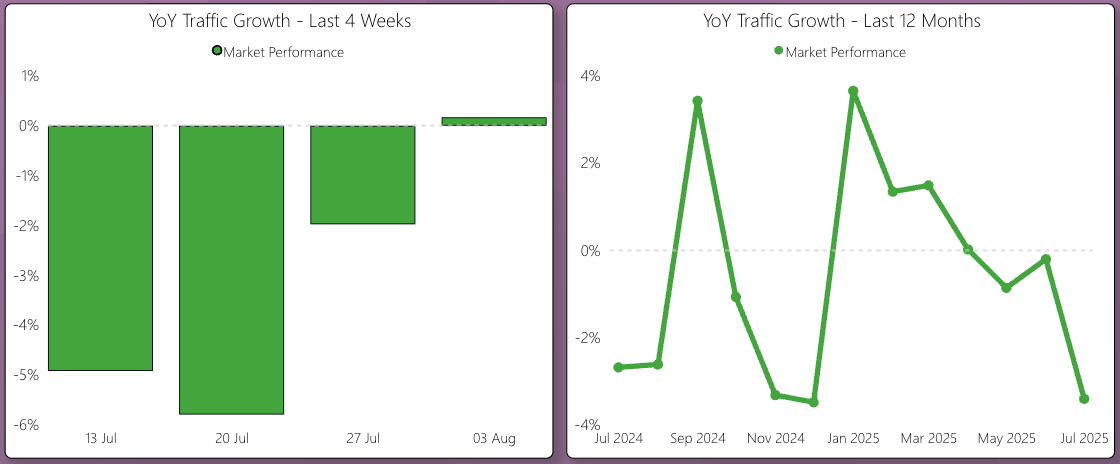

After a brief lift in June, UK eCommerce revenue dipped again in July, falling just under 2% YoY. This suggests the market is still in a fragile state, with demand fluctuating month to month and failing to find firm footing after the Q2 volatility.

While April and June showed promising signs of growth, the return to decline in July reinforces a sluggish summer outlook for online retail. Traffic has largely stabilised, but revenue and orders are lagging, indicating that shoppers are browsing more than buying- or being more selective with their purchases.

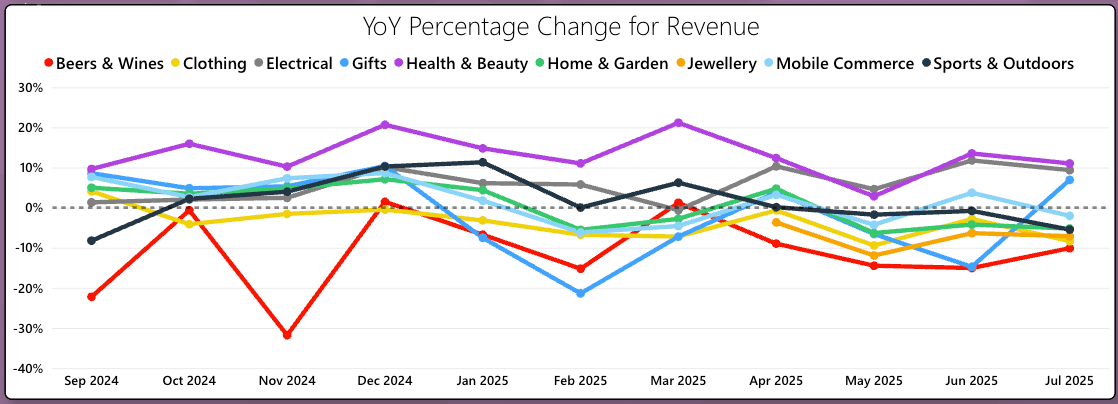

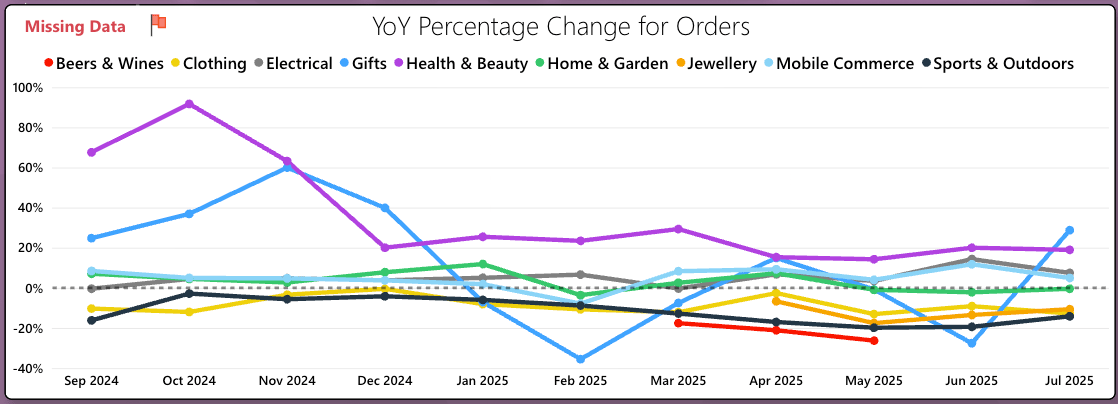

At a category level, most sectors followed the overall market trend, with few standout performances. Health & Beauty continued to outperform with strong YoY growth in both revenue and orders, while Mobile Commerce showed signs of recovery, particularly in traffic. In contrast, categories like Home & Garden and Beers & Wines remained in decline, weighed down by ongoing consumer hesitancy around big-ticket or non-essential purchases. Overall, July’s performance rounds out a turbulent Q2/Q3 crossover, signalling the need for brands to stay agile ahead of the late summer sales period.

Market-Wide Performance

Total market data for eCommerce revenue (IMRG)

IMRG data shows YoY traffic and revenue growth across all industries and compares this trend over 12 months YoY.

Category Breakdown

Case Study: How Ruggable Tripled Non-Brand Revenue with a Unified SEO & PR Strategy

As eCommerce brands rethink their approach to growth, Ruggable has strategically pivoted to capture the long-term benefits of organic marketing.

By unifying SEO and Digital PR into one powerful strategy — and rolling it out consistently across multiple markets — they’ve gone from a challenger brand to the category leader, achieving sustainable, scalable results.

Key Insights from Ruggable’s Growth:

£1m+ in non-brand revenue growth with an ROI of over 1,000%

3x increase in non-brand revenue in just 12 months

From 1,000 to 4,500 page-1 keywords, driving higher visibility and authority

3,000% boost in overall search visibility

Now the leading pure-play brand in their category

The Strategy Behind the Numbers:

Centralised international SEO approach across DE, FR, AUS, USA & UK

Always-on, highly relevant Digital PR to build authority and brand recognition

Positioning ahead of trends to capture emerging search demand

Site architecture optimisation and focus on colour-based landing pages

Technical enhancements for a complex Headless Shopify setup

Industry Context: Why This Matters for eCommerce Growth

Organic Reach vs. CPCs: Paid media costs continue to rise, with CPCs projected to double by 2027 — threatening profitability for paid-heavy brands.

Consumer Sentiment: 68% of eCommerce shoppers prefer brands that engage authentically, highlighting the value of organic brand-building.

Conversion Trends: Organic-first brands are seeing a 15% higher average conversion rate compared to those reliant on paid channels.

Ad Fatigue Impact: 43% of users now express negative sentiment towards constant ads, making non-intrusive marketing more effective.

Long-term ROI: Organic channels consistently deliver sustainable returns, with brands seeing up to 40% cumulative ROI over three years.

The Takeaway:

By investing in a consistent, international organic strategy — and aligning technical SEO with creative PR — Ruggable achieved exponential growth without relying heavily on paid channels. This approach not only delivered short-term revenue gains but also built the brand’s long-term authority and market dominance.

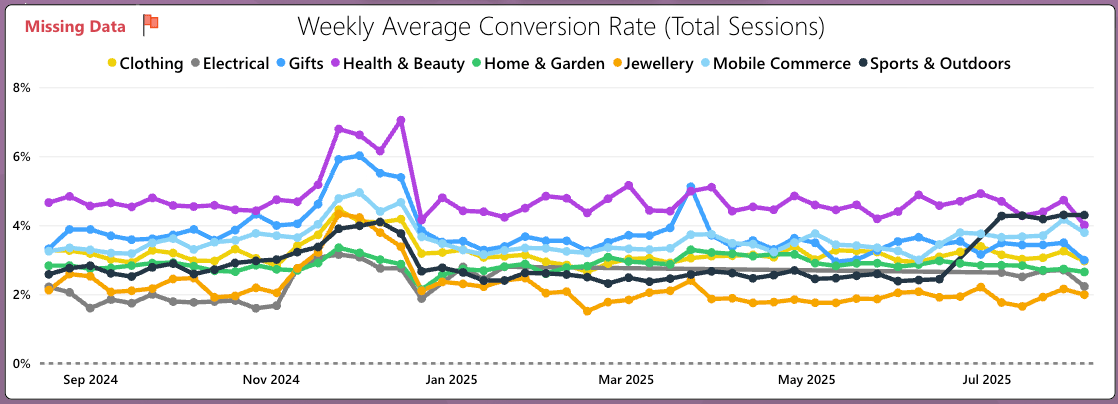

Conversion Rate Trends

This month, we examine how conversion rates shifted across the UK eCommerce landscape in July 2025 — with a closer look at performance across both mid-market/budget and premium price points.

Total Market Overview

After a relatively strong performance in June, total market conversion rates declined steadily through July, dropping back toward 3% by month-end.

This cooling-off likely reflects classic summer seasonality — with consumers travelling, holding off on big purchases, or waiting for August promotions. Despite the dip, CVR remains in line with July 2024 levels, suggesting broader stability in shopper intent year-on-year.

Budget & Mid-Market Conversion Trends

Performance was steady but unspectacular across most value-driven and mid-market categories.

📱 Mobile Commerce led the pack again, with conversion rates peaking mid-month — reinforcing mobile as a key channel for conversion.

🏕️ Sports & Outdoors climbed consistently through July, driven by seasonal demand.

🏡 Home & Garden and 💄 Health & Beauty held steady, though momentum slowed compared to earlier summer peaks.

👗 Clothing and 💍 Jewellery continued to underperform, with signs of shopper fatigue in discount-heavy categories.

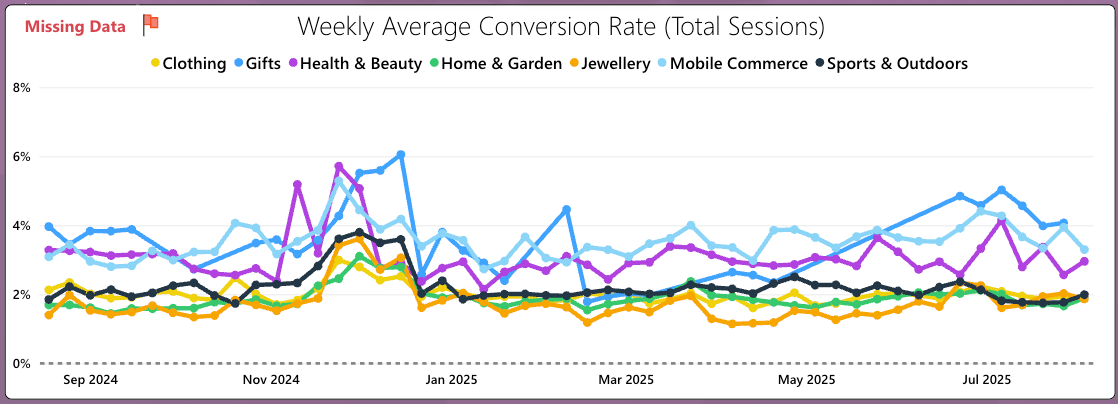

Premium Conversion Trends

At the higher end, conversion rates were more volatile, with sharper shifts in shopper behaviour.

📱 Mobile Commerce remained the top-performing premium channel — mobile UX clearly matters more than ever for high-value purchases.

💄 Health & Beauty dipped mid-month but held a strong relative position overall.

🎁 Gifts showed a quiet lift — potentially tied to seasonal events, travel gifting or special occasions.

👔 Clothing and Jewellery struggled, suggesting continued caution around non-essential premium purchases.

What This Means

While the July slowdown isn’t unexpected, it offers important signals for Q3 planning:

Lean into mobile optimisation – With mobile leading conversion across both price points, brands should invest in UX improvements, faster checkout flows, and mobile-first creative.

Don’t wait for peak season – Brands that build early demand through low-lift summer campaigns or tease autumn/winter drops may be better positioned when consumers re-engage in late August.

Test gifting hooks – The quiet rise in premium ‘Gifts’ hints at a potential opportunity for travel-related or personalised product pushes during quieter months.

Keep an eye on fatigue – Sluggish CVRs in Clothing and Jewellery (across all price points) may reflect consumer weariness- brands should explore new creative angles, value messaging, or bundling to re-engage interest.

Total market conversion rate weekly (IMRG)

As always, understanding price-point-specific behaviours and category nuances remains key. We have further breakdowns available below.

Weekly total market conversion rate (IMRG)

Weekly mid-market + budget CVR (IMRG)

Weekly premium/luxury CVR (IMRG)

Weekly conversion rate for budget + midmarket (IMRG data)

Weekly conversion rate for luxury price range (IMRG data)

Reserve Your Spot at Our Upcoming Webinar: How to Adapt Your eCommerce Strategy For AI Search - with The CMO Circle

“How do eCommerce brands future-proof their strategy for AI Search?” It's a question we’re seeing more and more across marketing communities.

Join our webinar to hear more about what really matters as the new era of search expands. We'll be myth busting and debunking some of what you’ve read on LinkedIn to make sure you are focusing on what's really going to drive impact.

We'll be covering:

• SEO vs. GEO: is there a difference?

• Where eCommerce brands are missing big opportunities

• How to actually measure success in AI-driven search

Tuesday 23rd September | 1-2pm BST

Subscribe to The Scoop for More!

Each month, we collate our monthly reading into a singular LinkedIn newsletter, offering our take on significant industry news, trends and insights.

To stay up to date with the latest in the SEO and eCommerce industry, subscribe today and check out our latest edition.

Thanks for reading, if you found this valuable, please send this link to a fellow eCommerce marketer so you can also help them.