- Organic eCom

- Posts

- Organic eCom: State of Play for eCommerce Brands

Organic eCom: State of Play for eCommerce Brands

Plus: Notes from Pulse & How to approach your probation period as an eCommerce leader

Welcome to our monthly newsletter, which focuses on helping you reduce your reliance on paid media.

This week, we have a data-heavy update covering all aspects of eCom performance for March and YTD.

This is a reminder that we’ve recently changed how we share updates. You’ll get this update about the industry and general snapshots each month, and then we’ll also share a deep-dive post directly from our substack each month.

Here’s what we’re diving into today:

♻️ Notes from Pulse

🗣️ What’s trending

💼 30/60/90: How to approach your probation period

📈 eCommerce sector performance March

Notes from Pulse

If you’re reading this newsletter, you likely work in eCommerce; if you do, your LinkedIn feed has probably been littered with posts praising the Vervaunts Pulse event.

We led the State of SEO panel and contributed to the CRM loyalty roundtable.

Below is a top-line view of our key takeaways; a more detailed write-up is in the link below.

Customer Loyalty

Multiple purchases drive retention - customers who buy twice are significantly more likely to return.

Loyalty programmes are evolving beyond discounts towards personalised experiences.

Post-purchase journey, particularly returns, is crucial for customer satisfaction.

Technology & Innovation

AI adoption is growing for operational tasks, though content creation remains largely human-led

Tech stack simplification is vital for cross-channel efficiency

High-traffic flash sales giving way to managed ballot systems

Regional Insights

UK and US projected for strong growth

France favouring click-and-collect services

Germany showing high return rates but strong exchange programmes

Key Focus Areas

First-party data collection driving personalisation

Community building replacing discount-led loyalty

Rising advertising costs pushing focus towards organic growth (see Meta CPC forecasted growth below)

Returns fraud emerging as a significant challenge

Facebook ad costs are higher than ever

What’s Trending?

Our Digital PR work focuses on positioning clients' brands ahead of the latest trends. We develop strategic campaigns and newsjacking opportunities through comprehensive trend analysis and research.

Here are our current trend insights across key categories:

💄 Makeup & Cosmetics:

A surge in personal colour analysis shows shoppers want guidance on what suits them - a significant UX and content opportunity (particularly for PDPs and quizzes).

Hybrid skincare and makeup continue to rise: SPF lip balm, lip serums, glow blush—shoppers want performance and care.

Simplicity and efficiency are valued: all-in-one products show steady growth.

🧥 Fashion & Accessories:

There has been a notable movement in accessories, rings, and bracelets, particularly those with a raw or mineral aesthetic (e.g., pyrite, nugget, moss agate).

Y2K fashion and retro styling remain strong, with flared jeans and denim accessories returning to popularity (or at least searches!)

Opportunity to target giftable fashion items with compelling visual merchandising, social media try-ons, and educational search content.

💅 Beauty:

Consumers are increasingly skincare-savvy, seeking targeted ingredients (such as exfoliating or tranexamic acids).

Beauty technology and professional-level devices (including red light therapy and photobiomodulation) show growing demand for at-home clinical-style treatments.

Russian manicures — whilst niche, signal increasing interest in precision-based nail services and content opportunities.

🏠️ Home & Interiors:

Warm, earthy tones like peach and orange are experiencing a resurgence, reflecting broader trends towards optimism, softness, and warmth in interiors.

There are significant differences in UK versus US spelling variants, e.g., 'colour' versus 'color'. This trend spans multiple industries; we believe it’s likely influenced by increased exposure to American content through social media platforms, particularly TikTok. The rise of AI has also increased UK exposure to more US-led spelling.

Contact us for additional insights specific to your sector, including comparative analysis of trending terms across yearly, quarterly, or monthly periods.

How to Approach Your Probation as an eCom Leader (30/60/90)

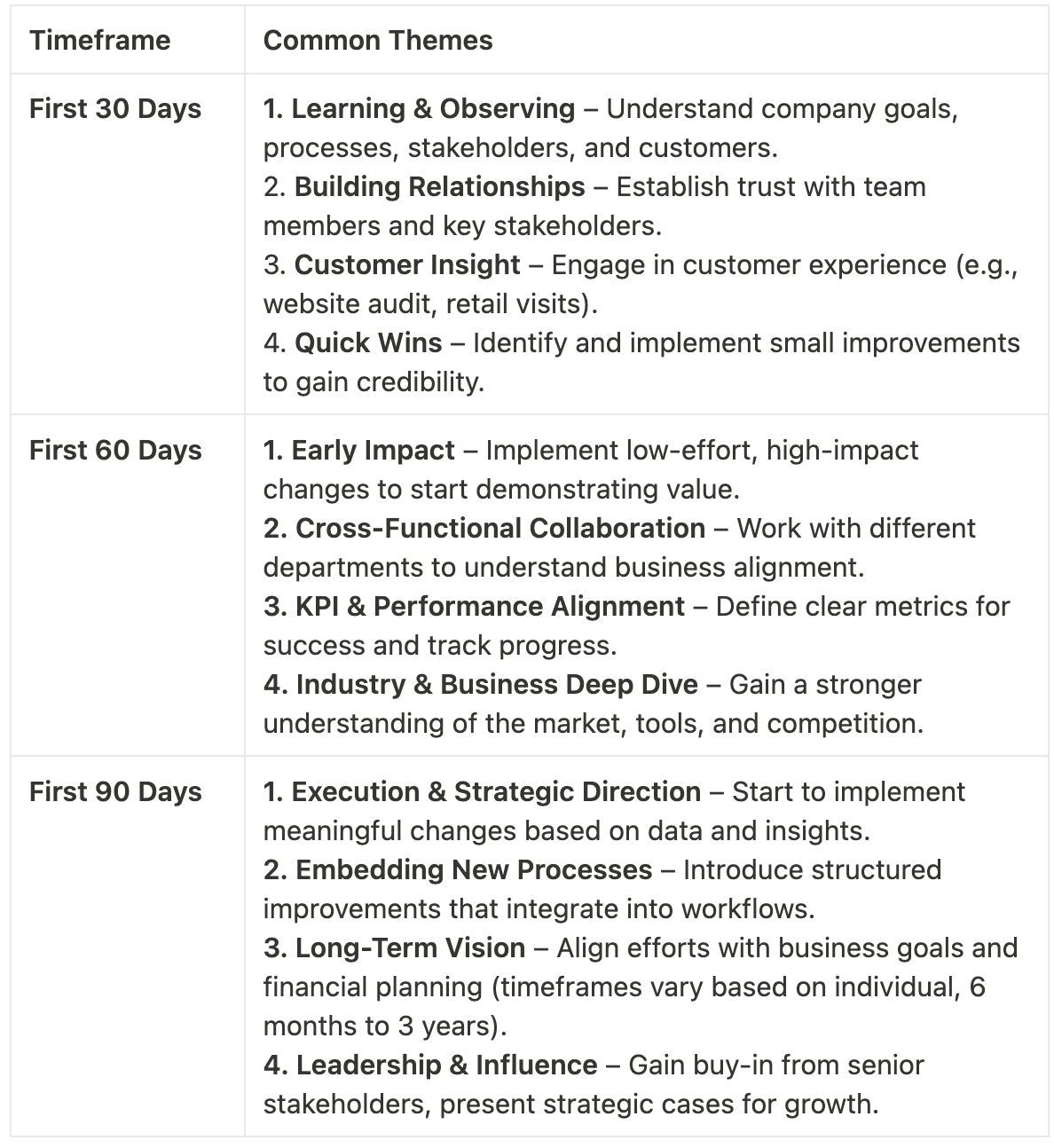

We asked six eCommerce leaders about their approach to probation periods when starting new roles. These periods typically follow a structured timeline of 30, 60, and 90 days.

We’ve collaborated with eCommerce recruiter James C, who runs withFrontier, to bring you this guide. He’s the best eCom recruiter in town, independent and specialised. His email is [email protected] if you are looking to hire anytime soon.

This is a super top-level summary of all six eCom leaders' approaches to their probation periods; if you’d like to read more detail, please see the guide below.

In collaboration with James, eCommerce recruiter @ withFrontier

If you are moving jobs soon, this is the guide for you, OR if you know someone who’s about to move roles, forward this link to them, too.

Thanks again to all the eCommerce leaders who contributed and shared their insights with us (and now you!)

eCommerce Performance in March

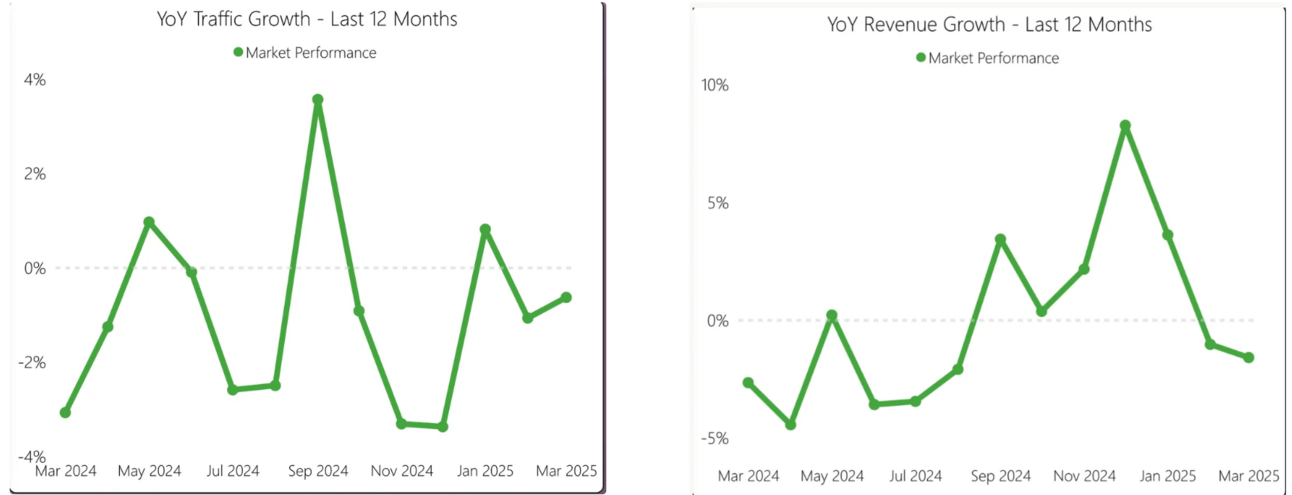

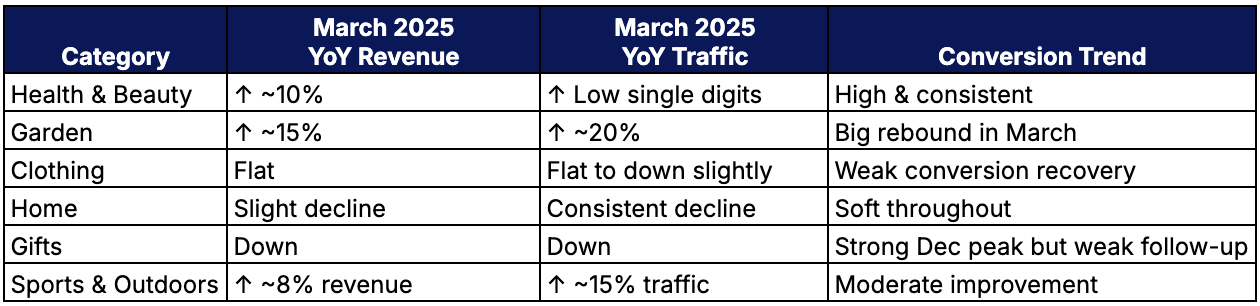

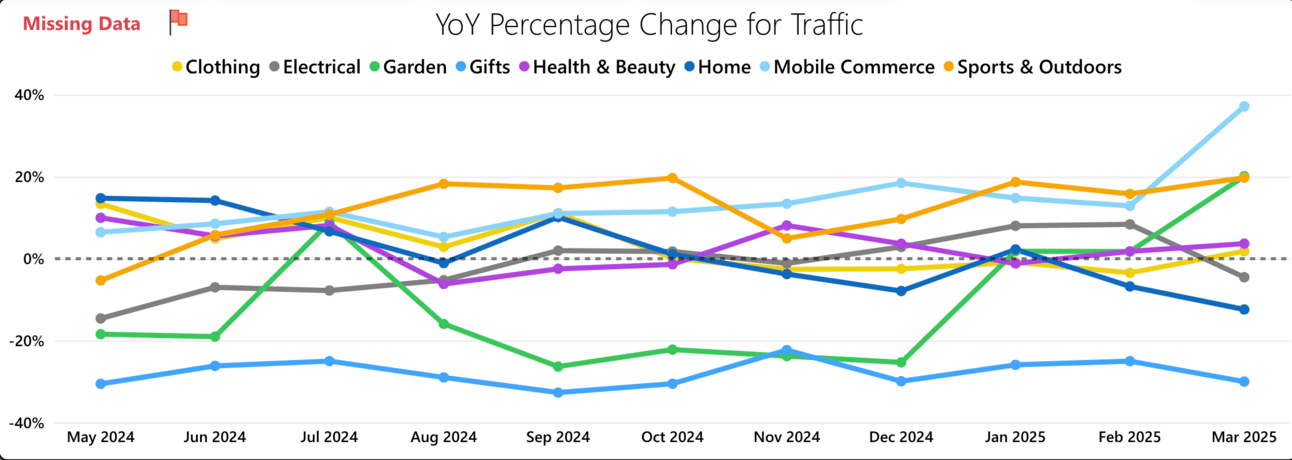

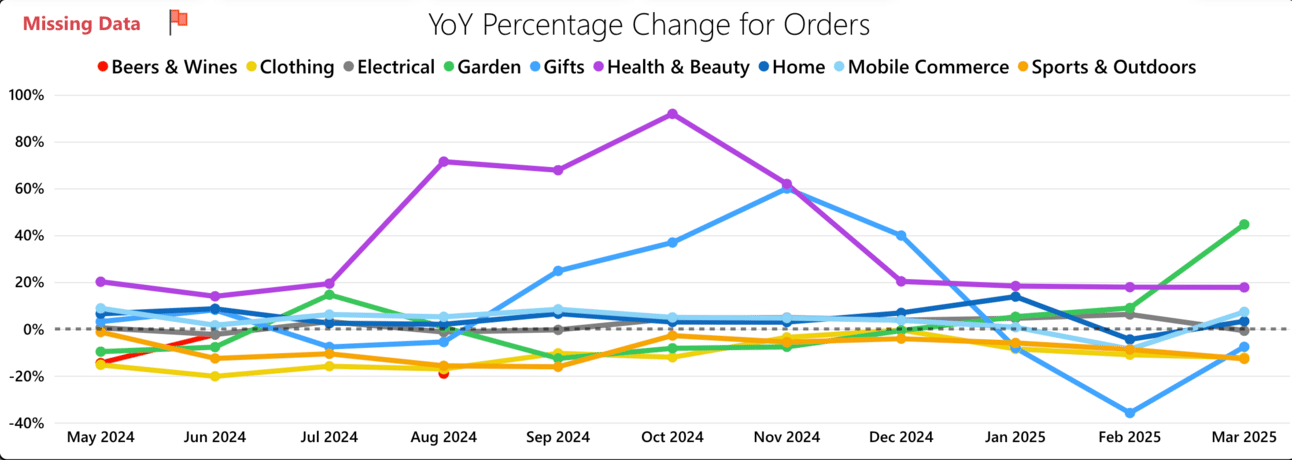

The UK eCommerce market experienced YoY declines in both traffic (-0.6%) and revenue (-1.6%) in March 2025. This indicates a cooling post-peak season, though performance varied significantly across categories and price points.

It’s important to note that in 2024, Easter fell in March, but in 2025, it’s in April, so this will have a big impact on numbers when viewed on a monthly basis.

IMRG data showing YoY traffic and revenue performance

The overall trend is down; however, we can see Gifts, Mobile and Home causing a skew when you break this down into different categories and segments.

AI Summary of raw data shown below

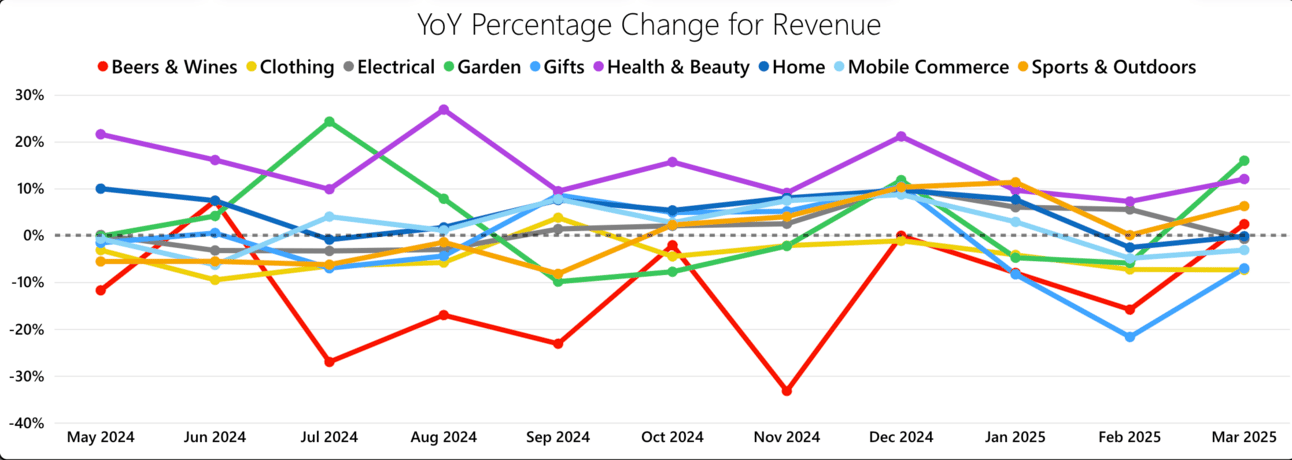

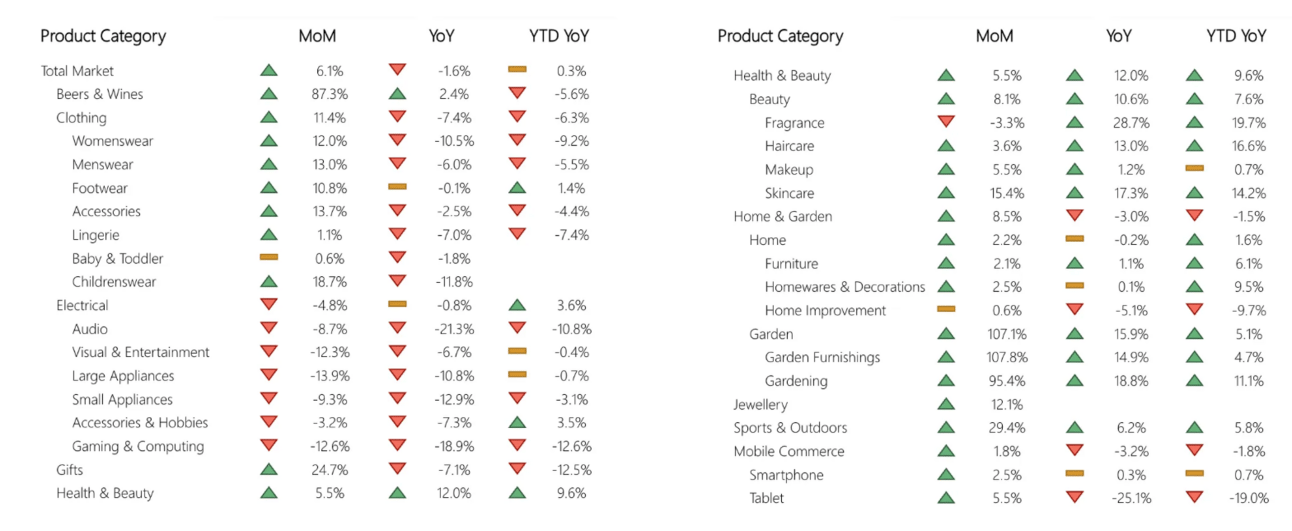

Full Category Performance Deep Dive

Below is a detailed category-level breakdown comparing how different categories are performing month on month, year on year, and year to date.

🟢 MoM growth looks encouraging.

The total market is up 6.1% MoM, signalling a spring rebound. Many categories have recovered from February lows, a familiar seasonal pattern.

Notably strong performers include:

Beers & Wines: The +87.3% MoM is likely driven by seasonal restocking and early Easter events, as well as the potential end of January and February detoxing.

Gardening: +95.4% MoM aligned with seasonal interest and recent good weather.

📉 YoY is still flat or in decline across many categories

Despite the MoM lift, the market remains down -1.6% YoY.

Fashion shows particular weakness:

Womenswear -10.5% YoY

Childrenswear -11.8% YoY

Footwear flat -0.1% YoY

💄 Beauty is a rare bright spot

YoY growth:

Fragrance - +28.7% YoY growth

Skincare - +17.3% YoY growth

Haircare - +13.0% YoY growth

Beauty Total - +10.6% YoY growth

Summary:

Growth spans broadly across subcategories.

Despite economic pressures, consumers maintain spending on self-care and visible impact categories.

Skincare and wellness-oriented products (featuring scientific claims or ingredient-led USPs) show continued resilience.

🪴 Home & Garden is picking up early

Garden (+15.9% YoY) and Garden Furnishings (+14.9%) demonstrate strong seasonal performance.

Meanwhile, Home (-0.2%) and Home Improvement (-5.1%) continue to lag.

🎮 Consumer Tech is in decline

Audio (-21.3% YoY), Gaming & Computing (-18.9%), Small Appliances (-12.9%) show significant YoY declines.

🛒 Conversion Uplift ≠ Sustained Growth

While many categories show MoM improvements, they lag behind YoY or YTD YoY.

Jewellery, Makeup, Mobile Commerce post modest monthly gains, but YoY/YTD indicates stagnation.

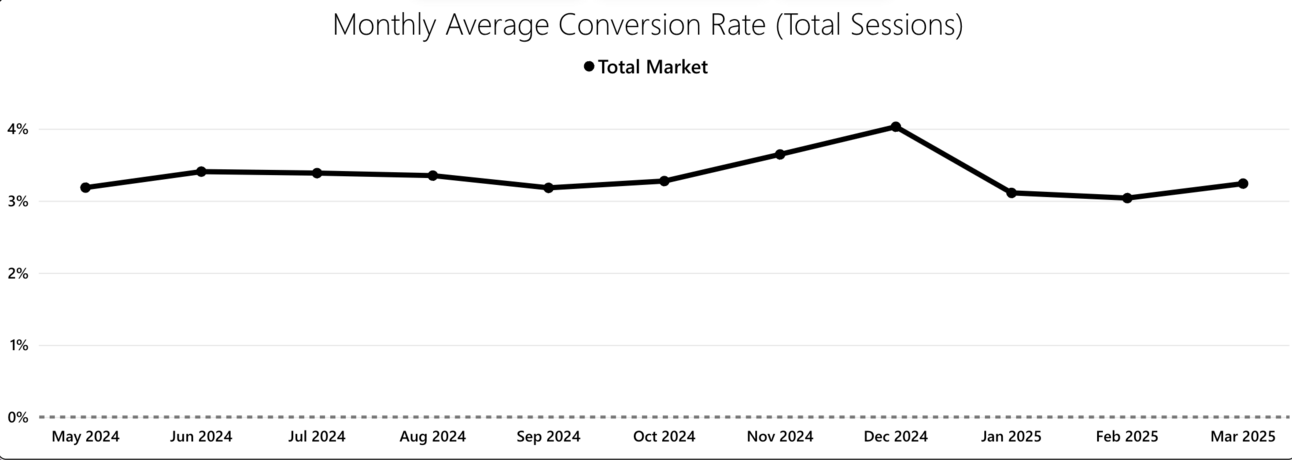

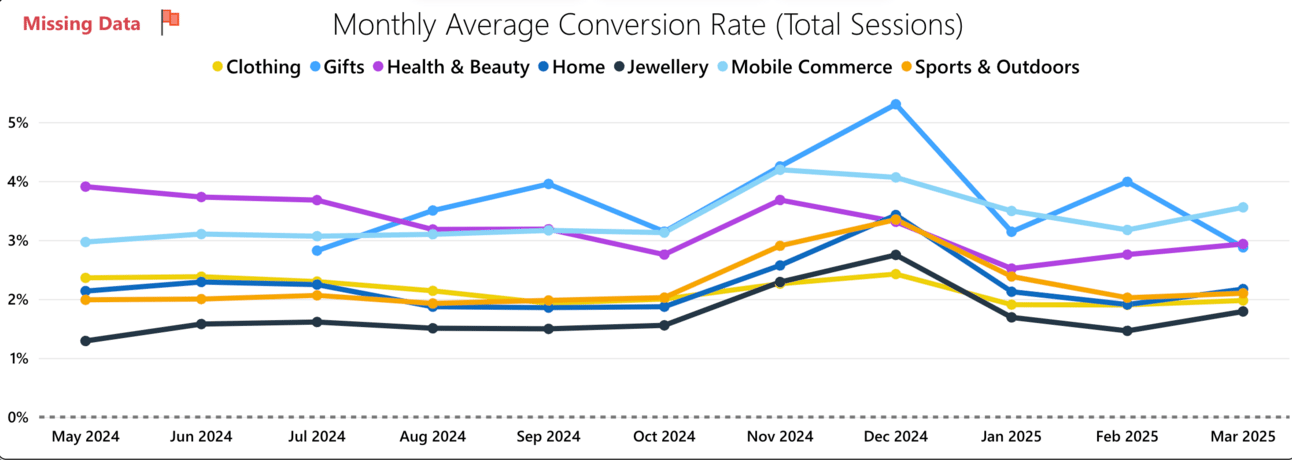

Conversion Rate Trends

In this section, we focus on the conversion rate trend of the UK eCommerce market.

🟠 Premium brands experienced steeper drops in conversion rates from January–March 2025.

Despite stable or increasing traffic across some verticals, premium conversion rates fell below 3%.

This decline reflects cautious consumers delaying high-value, discretionary purchases amid inflation.

🟡 Mid-market and budget brands maintained better stability.

Conversion rates held steady at 3–4.5%.

Performance remained strong, especially in functional or replenishment-driven categories.

🧠 Summary: Consumers continue to shop with greater discretion—prioritising value and price more than before.

IMRG data for Total market average CVR

IMRG data for Midmarket and budget conversion rate trends

IMRG for Premium price point conversion rate trends

Thanks for reading, if you found this valuable, please send this link to a fellow eCommerce marketer so you can also help them:

Subscribe to The Scoop on LinkedIn

Each month, our Head of SEO, Tom, collates his monthly reading into a singular LinkedIn newsletter, offering his take on significant industry news, trends and insights.

To stay up to date with the latest in the SEO and eCommerce industry, subscribe today and check out our latest edition, including:

Amazon’s latest shopping feature

Social Media’s Influence on influencing purchase

Noindex tags as severe directives

AI Overviews uplift